Monitoring the Cash Flow Using the Direct Method

Cash flow planning is a concept that every business owner or CFO needs to know. It includes looking at a company’s assets and income while balancing them with current and future liabilities. It takes into account goals for the growth of the company, the development of new products and services, and the search for efficiency in their realization. Investors love companies with strong cash flows, where income is reliable and growing and where liabilities are predictable.

A cash flow plan outlines all current and anticipated future needs and goals of the company. It provides a greater opportunity for the company to achieve more. In addition, it helps determine the return on investment and savings to achieve goals over a given period.

Following the implementation of preventative measures in the organization for work and care for employees, the responsible in the company have to ensure and continue to generate positive cash flow in the company. To maintain liquidity, solvency and capital adequacy the company must generate a positive cash flow even in difficult circumstances. If a company fails to do so, it might “not exist anymore” in the future.

In turbulent times, keeping a close eye on your money projections is crucial. The company must plan the number of factors such as billing conditions, credit terms, payday loans to be better prepared. Evaluating money stories will dramatically secure the capabilities of organizations. That means finding the biggest income-generating candidates in a certain amount of money spent by your major cost drivers.

Regardless of the cash flow planning and design methodology CCH Tagetik software simplifies everything. It automates many types of planning in a single solution. It also updates and simplifies the process and facilitates collaboration between financial and operational planners.

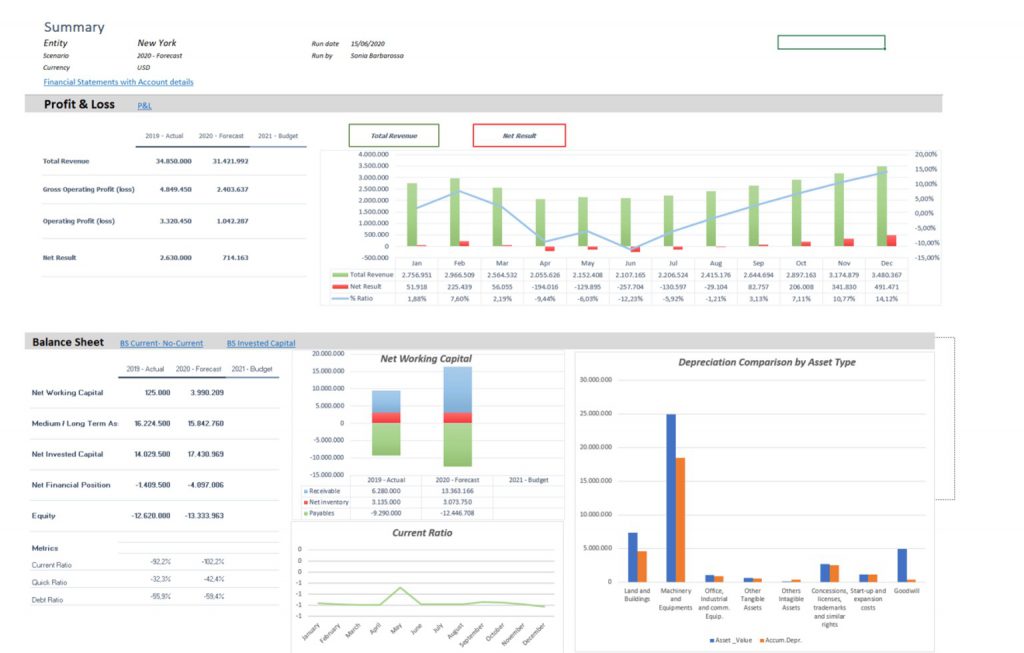

Companies need to review cash flow and working capital forecasts, prepare profit and loss scenarios, balance sheets and cash flows with varying levels of interruption. Planning for expected receivables and liabilities is just as important as planning for money. Positive cash flow is the main prerequisite for the implementation of other necessary measures to maintain a healthy business and financial core of the company.

The cash flow statement presented under the direct method contains all major cash receipts and payments in the period by source. In other words, it indicates where the cash inflows came from. It usually comes from customers and usually goes towards employee salaries, payments to suppliers, etc. Cash flow planning using the direct method includes the planning of open items (invoices issued and received) and short-term receivables and liabilities.

After collecting all the data from all sources, it’s time to calculate the net cash flow from operations. The direct method uses assuming the cost and revenue planning for not yet received invoices. Therefore allowing the monitoring of their maturities and schedule it time baskets. The direct method prepares a daily forecast for 4 weeks’ horizon, a weekly forecast for 14 weeks’ horizon, and a monthly forecast for 6 months’ horizon. An indirect method of monitoring and planning cash flow is foreseen to monitor longer forecasts.

In addition, cash flow planning is used to calculate the weekly liquidity ratios (forecasting and monitoring of the actual situation). It also provids an insight into the actual balance of credit liabilities.