What is ESG reporting?

ESG stands for Environmental, Social, and Governance. It refers to a set of criteria used to evaluate a company or investment based on its impact in these three key areas.

Environmental

includes issues focused on climate risks, carbon emissions, energy efficiency, use of natural resources, pollution and biodiversity

Social

includes issues focused on human capital, labor regulations, diversity, DEI, safety, human rights and community involvement

Governance

includes issues focused on board diversity, corruption and bribery, business ethics, compensation policies and general risk tolerance

ESG reporting must disclose those three pillars. As with all disclosures, its purpose is to shed light on a company’s ESG activity while improving investor transparency and inspiring other organizations to do the same. Reporting is also an effective way to demonstrate that you’re meeting the goals and that your ESG projects are genuine — not just greenwashing, empty promises, or lip service. Since ESG reports summarize the qualitative and quantitative benefits of a company’s ESG activity, investors can screen investments, align investments with values, and avoid companies with the risk of environmental damage, social missteps, or corruption.

ESG Reporting & CCH Tagetik

CCH Tagetik’s ESG & Sustainability Performance Management Expert Solution (ESG Solution) offers pre-built data models, normalization and calculation rules, as well as disclosure capabilities to ensure compliance with current regulatory frameworks and the most widely used reporting standards. CCH Tagetik has developed an ESG pre-packaged solution that helps companies to face challenges, reduce risks and provide key actors with strategic information to turn risks into opportunities to create long-term value.

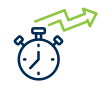

CCH Tagetik covers the ESG process end to end, boosting the implementation thanks to an expert solution that combines all the regulatory frameworks and the managerial needs in a single application

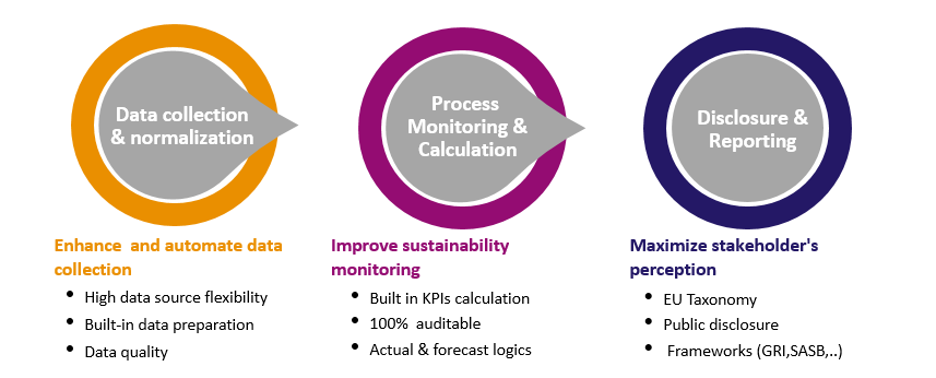

The CCH Tagetik ESG Solution consists of four modules

- EU Taxonomy

- ESG Metrics and KPI’s

- CSRD

- Carbon emissions

Strengthen Your CSRD-Compliant ESG Strategy

CRMT offers a suite of ESG solutions tailored to meet the structured requirements of CSRD:

- Double Materiality Assessment

Gain insights into the dual impact of ESG on both financial performance and societal outcomes, empowering CFOs to align sustainability goals with strategic business objectives. - GHG Emissions Reporting

Simplify Scope 1, 2, and 3 emissions reporting with CRMT, following the GHG Protocol to integrate emissions data across operations for comprehensive compliance. - Preconfigured ESG Indicators for CSRD Reporting

Our library includes over 1,500 indicators aligned with CSRD requirements providing thorough coverage of all essential data points to ensure full compliance in your disclosures.

Partner with CRMT for a Smooth Transition to Sustainability Reporting Compliance

ESRS XBRL Tagging

As the transition to digital tagging of sustainability disclosures under CSRD accelerates, aligning with the latest ESRS XBRL taxonomies is critical for ensuring compliance and enhancing transparency. CRMT’s expertise helps your organization meet these requirements efficiently and accurately.

Automation in invoice capture

Automation in invoice capture can significantly simplify the way invoices are processed and managed while increasing productivity and optimizing accounting processes.

Our program captures utility invoices from different service providers to transfer key data for further processing in CO2 emissions calculations and other items that must be reported under the ESRS standards.

If you want to save time and automate processing large volumes of invoices, don’t hesitate to contact us. We will help you with the process.

Read more about ESG

The Ultimate ESG Reporting Guide

With mandatory ESG reporting fast approaching, we decided to publish our ESG reporting guide.

Embracing ESG Reporting: Redefining Corporate Excellence

Let’s take a closer look at the benefits of ESG.

Watch video of our Immersive ESG Event

We’ve prepared a comprehensive webinar for you, where we discussed the legal and content-related aspects and the necessary information support.

Technology

Wolters Kluwer

Wolters Kluwer has earned the esteemed title of Leader in the 2023 Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions.