Financial statements tagging

The European Banking Authority (EBA) published updates related to the reporting framework 3.0 and the implementing technical standards (ITS) on Pillar 3 public disclosures by institutions. These updates are the result of the European Commission’s adoption of the implementing technical standards on supervisory reporting (version 3.0) on December 17, 2020, the EBA publication of the revised version of the mapping between disclosures and reporting, and the EBA release of phase 1 of the technical package on the reporting framework version 3.0.

EBA is updating the mapping of quantitative disclosure data and supervisory reporting and has published a file summarizing the frequency at which each type of institution should disclose each template and table, in accordance with the CRR2. The EBA tool provides a mapping tool between the Pillar 3 implementing technical standards on disclosures and the implementing technical standards on supervisory reporting (version 3.0). The Pillar 3 implementing technical standards on public disclosures have been developed to foster consistency across supervisory reporting. The mapping also aims to facilitate institutions’ compliance and improve the consistency and quality of disclosed information.

The Phase 1 technical package of reporting framework (version 3.0) provides the standard specifications for the implementation of EBA reporting requirements. The package includes the validation rules, the Data Point Model (DPM) data dictionary, and the XBRL taxonomies for v3.0. EBA also updated the DPM query tool. The technical package includes reporting requirements on FINREP, COREP, own funds (including the Fundamental Review of the Trading Book), COREP liquidity, asset encumbrance, large exposures, leverage ratio, and global systemically important institution (G-SII) data.

The main changes compared to the previous version of the EBA reporting framework relate to the following:

- New ITS on supervisory reporting replacing Regulation (EU) No 680/2014, including new reporting requirements and changes to the reporting on

- own funds (incl. backstop for non-performing exposures)

- credit risk and counterparty credit risk

- large exposures

- leverage ratio

- net stable funding ratio

- FINREP

- G-SII indicators;

- New ITS on disclosure and reporting on MREL and TLAC

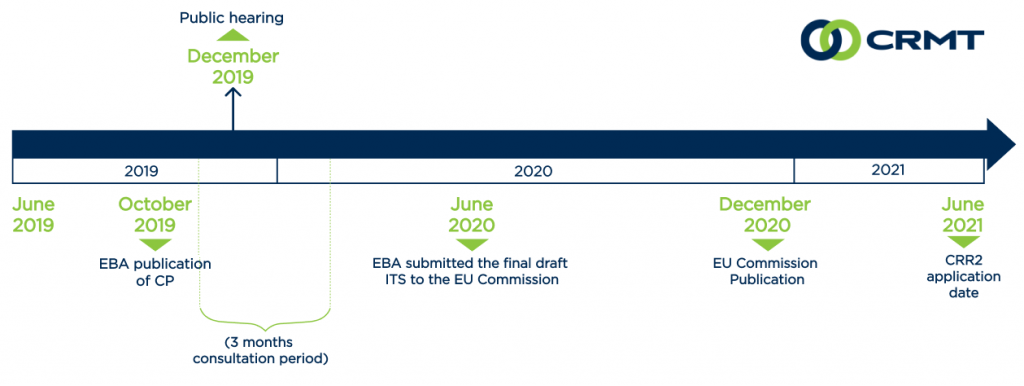

Timeline

EBA supervisory reporting

Wolters Kluwer’s EBA Supervisory Reporting is pre-packaged with all the end-to-end regulatory compliance tools banks need to meet the demands for greater disclosure by FINREP, COREP, Asset Encumbrance, Funding Plan, and ALMM. By automatically populating reporting templates with your EBA compliant data, finance isn’t weighed down by the burden of regulatory reporting. Wolters Kluwer’s automated solution carries the load so you can meet tight deadlines with ease.

EBA compliance is more than just generating the required reports. Compliance starts with data collection and includes every stepuntil final disclosure to the market and regulators —needless to say. Wolters Kluwer comes pre-packaged with a complete set of accounts, pre-built FINREP and COREP templates, diagnostic checks, calculation rules, consolidation logic, multi-GAAP support, and XBRL outputs.

Wolters Kluwer has built-in financial intelligence to manage all EBA reporting requirements.

- Automated data loading, collection, and mapping

- Built-in controls, diagnostics, and validations

- Intercompany reconciliation tools

- Support for multi-entity consolidation with currency and ownership capabilities

- Reconciliation with IFRS data for consistency across FINREP / COREP and IFRS reports

From data collection to final disclosure to the regulators, Wolters Kluwer’s EBA Supervisory Reporting comes with all the capabilities, financial intelligence, and process governance you need to address FINREP and COREP compliance and beyond.

- Ensure accuracy with controls, diagnostics, and validations

- Automatically cascade data into pre-built templates

- Workflow guides you from data collection to approval

- Reconciliation and matching with our intercompany cockpit

- Flexible configuration to meet your specific requirements

Wolters Kluwer’s EBA Supervisory Reporting solution integrates seamlessly with all data sources and existing applications so you have a single platform for all financial performance management processes. Always up-to-date, we’ll keep your solution aligned with fluctuating EBA regulations with regular maintenance.

- Achieve fast compliance with a pre-packaged solution

- Easily map data from multiple sources

- Reconcile FINREP and COREP data with IFRS reporting

- Collaborate with all contributors

- Align stakeholders on one version of truth

Technology

Explore other resources

CRMT Becomes Wolters Kluwer PLATINUM Partner

We are proud to announce that CRMT is now a Wolters Kluwer PLATINUM partner. Over the many years of collaboration, we have proven our strong, experienced CCH ...

Read more6 reasons why you should join our webinar and get more information about our solution for IFRS 17

You will get insight into how CCH Tagetik IFRS 17 simplifies and ensures compliance in an easy to use preconfigured Solution which on the other hand is flexible...

Read more